Cgt Australia Cryptocurrency

A Capital Gains Tax Event Swapping Gifting Buying Disposing Converting to FIAT Using Crypto to buy goods and services I swapped coins do I pay tax Tax Guide. The type of tax payable as well as the quantity will depend on the specific features of the transaction.

Australian Cryptocurrency Tax Guide 2021 Koinly

A capital gains tax CGT event occurs when you dispose of your cryptocurrency.

Cgt australia cryptocurrency. There are 5 ways you could pay capital gains tax on crypto in Australia. CGT can usually only arise when you have both a CGT asset and a CGT event. The crypto is used to purchase goods or services for personal use such as booking hotels online or.

A capital loss is realised you dispose of an asset eg. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Under the Capital Gains Tax CGT regime as a CGT asset ie.

If you dispose of one cryptocurrency to acquire another cryptocurrency you dispose of one CGT asset. If cryptocurrency is not acquired or held in the course of carrying on a business or as part of an isolated transaction with a profit-making intention a profit on sale or disposal should be a capital gain. Capital gains may be discounted under the.

Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of. Capital Gains Tax or CGT. Because you receive property instead of money in return for your cryptocurrency the market value of the cryptocurrency you receive needs to be accounted for in Australian dollars.

If you dispose of one cryptocurrency to acquire another cryptocurrency you dispose of one CGT asset and acquire another CGT asset. An indirect interest in Australian real property you and your associates hold 10 or more of an entity including a foreign entity and the value of your interest is principally attributable to Australian real property. In short cryptocurrencies are subject to capital gain tax CGT and ordinary income tax in Australia depending on the circumstances of the transaction.

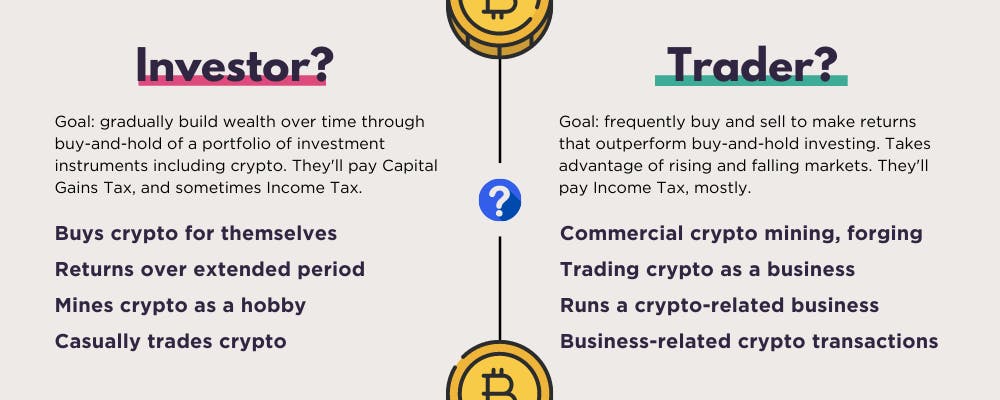

In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. Sell or gift crypto to someone. Cryptocurrency generally operates independently of a central bank central authority or government.

If you hold youll pay 50 less tax on crypto gains made after 1 year of purchase. Bitcoin for a lower value than you acquired it. If youre an investor CGT applies when you.

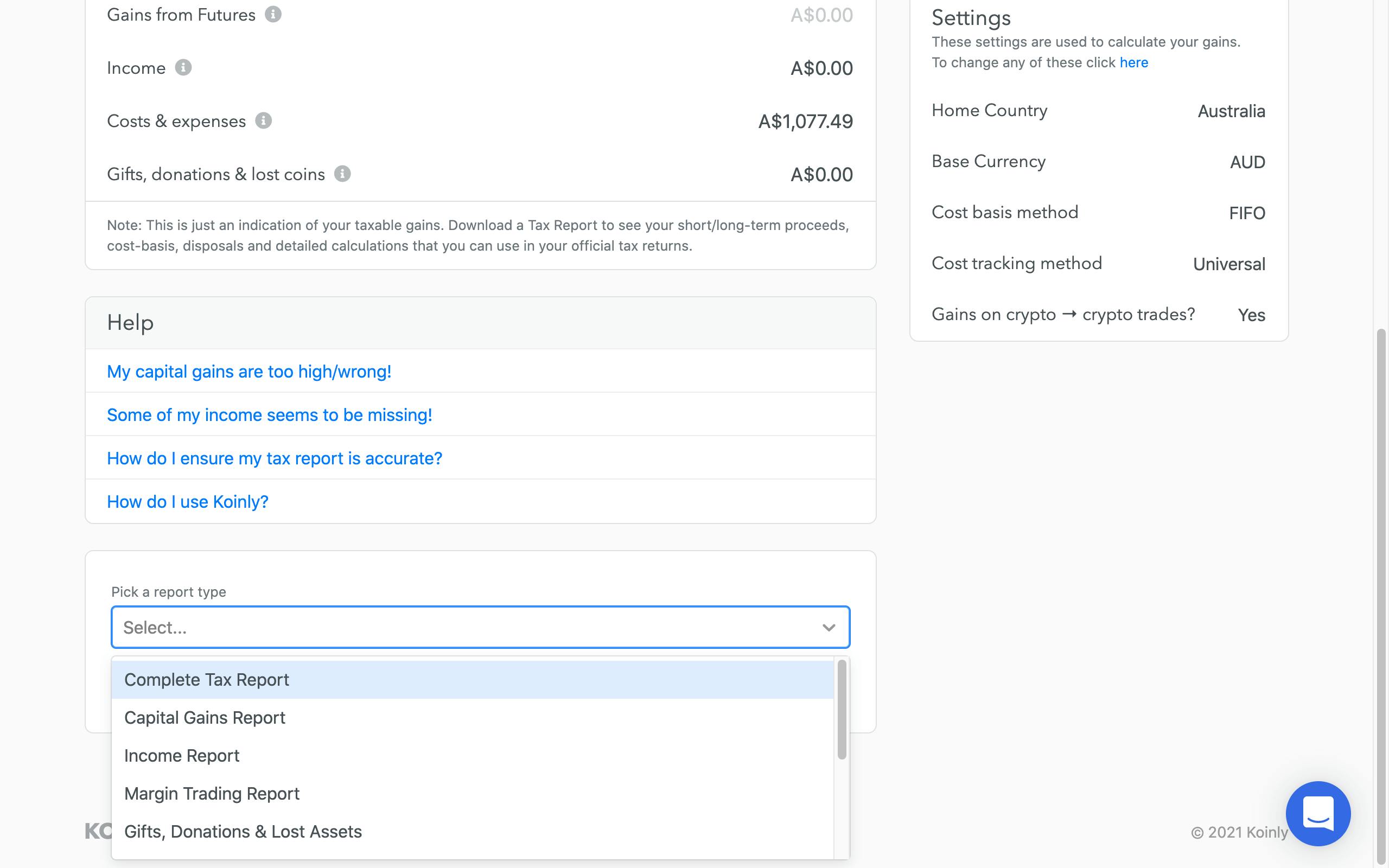

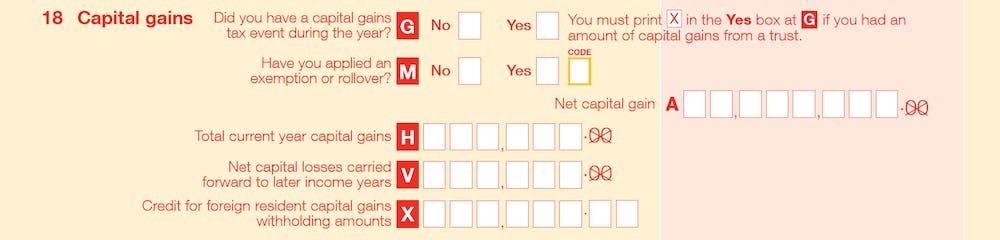

Trade or exchange crypto including trading one crypto for another convert crypto into regular fiat currency for example into Australian dollars. CGT is the tax you pay on the difference between the Australian Dollar AUD value of the disposed asset at the time of the disposition minus the AUD value of the disposed asset at the time it was acquired. Capital gains tax CGT Capital gains tax CGT is the tax you must pay on any capital gain made upon sale of the asset.

Cryptocurrency doesnt fall within this category of property meaning you dont need to report any CGT gains or losses to us when you complete your income tax return. Cryptocurrency transactions are exempt from CGT if. Say you bought one bitcoin for A10000.

For Australian Residents Note. Cryptocurrency with the intention of making a short-term profit and are not a cryptocurrency trader or holding the cryptocurrency as CGT asset the cryptocurrency is likely to be held as a revenue asset. The most common CGT event is CGT event A1 which is a disposal of a CGT asset.

Dispose means to sell gift trade exchange covert or use crypto. When you dispose of a cryptocurrency you will either make a capital gain or loss. In this regard the ATO has indicated that cryptocurrency is a capital gains tax CGT asset.

As well as acquire another CGT asset. Individuals transacting with cryptocurrency may incur tax liabilities in the form of Capital Gains Tax CGT or Income Tax. You hold it for six months.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. You dispose of cryptocurrency when you sell it trade it for another cryptocurrency. Most crypto activities are taxable either through CGT or income tax.

Use crypto to purchase goods or services. Bitcoin for a higher value than you acquired it. How is crypto tax calculated in Australia.

A CGT event occurs when you dispose of a cryptocurrencythat is when you sell it for AUD trade it for another cryptocurrency gift it to someone or in some cases when you use it to purchase goods or services more on this last point later. CGT occurs when you dispose of cryptocurrency. The Australian Tax Office has released official guidance on the tax treatment of cryptocurrencies.

The ATO views cryptocurrency as property and therefore it is subject to capital gains tax CGT. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. A capital gain is realised if you dispose of an asset eg.

If the cryptocurrency is considered to be a personal use asset you can disregard capital gains for CGT purposes it. The ATO view is that cryptocurrency is a CGT asset in Taxation Determination TD 201426 and there are very few assets of value that are not CGT assets. Australia Tax Capital Gains Tax Income Tax.

In Australia you might actually disregard some capital gains and capital losses from the disposal of cryptocurrencies under certain circumstances. If its an investment. Now youre aware of the cryptocurrency tax treatment in Australia and your obligations lets take a deeper look at the one that affects most Aussies.

Capital Gains Tax. Australias Cryptocurrency Tax Treatment.

Why Capital Gains Tax Does Not Work For Cryptocurrency By James Sangalli Medium

Crypto Tax Australia Crypto Capital Gains Obligations Pop Business

Australian Cryptocurrency Tax Guide 2021 Koinly

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Crypto Tax 2021 What You Need To Know Fullstack

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Crypto Tax In Australia The Definitive 2020 Guide

Australian Cryptocurrency Tax Guide 2021 Koinly

Did You Report Your Cryptocurrency Investing In 2018

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Cryptocate Cryptocurrency Tax Reporting Australia

Crypto Tax In Australia 2021 Everything You Need To Know

Crypto Tax Australia Guide 2021 Cryptocurrency Tax Swyftx

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker